This update is intended for those seeking additional insights into the Fall Economic Statement 2022 including its impact on both domestic and multinational enterprises.

Continue readingSelected Tax Measures in Canada’s 2022 Fall Economic Statement

TaxEd International | Fasken Tax Blog

Trends, analysis and insights in international tax

This update is intended for those seeking additional insights into the Fall Economic Statement 2022 including its impact on both domestic and multinational enterprises.

Continue reading

On December 8, 2020, Bill 213, Better for People, Smarter for Business Act, 2020 received royal assent. The bill includes significant amendments to the Business Corporation Act (Ontario)[1] (the “OBCA”). The amendments to the OBCA in Bill 213 were proclaimed into force on July 5, 2021.

Bill 213 eliminates the requirement that 25% of the directors of an Ontario corporation must be resident Canadians.[2] This means that non-residents may incorporate an Ontario corporation without necessarily retaining a Canadian resident as a director of the corporation (as already permissible in other jurisdictions).

In light of the new changes, many non-residents will likely consider incorporating an Ontario subsidiary to facilitate acquisitions, tax planning, and investment-related activities. This article highlights some of the (new) corporate and tax advantages of incorporating an Ontario subsidiary by such persons.

Continue reading

Accountants, engineers, lawyers, doctors, dentists. Now real estate professionals join the Ontario regulated professionals who are able to personally incorporate their business. Following several other provinces,[1] on October 1 2020, the Ontario government passed O/Reg 536/20: Personal Real Estate Corporations, under the Real Estate and Business Brokers Act, 2002, which provides that real estate salespeople and brokers may incorporate in Ontario. Incorporation allows a real estate professional to have their self-employed revenue paid directly into their personal real estate corporation (“PREC”), offering some tax advantages.

Tax Advantage

The key tax advantage of incorporation is that income earned in a PREC is taxed at the corporate tax rate, which is substantially lower than the personal tax rate.

In Ontario the combined federal and provincial corporate tax rate is 12.5% on the first $500,000 of active business income (a threshold amount that is shared among associated corporations), and 26.5% on income above that threshold. In contrast, the highest personal tax rate is 53.52% on income over $220,000. As a result, when income is retained in a PREC and taxed at the corporate rate, a greater amount of money is available for investment.

For example, if a real estate professional earned $500,000 in a year, without a corporation the professional would have approximately $266,344 of after tax income that could be invested. In contrast, making use of a PREC, the same income would result in approximately $437,500 of funds available for investment within the corporation.

This may increase the investment growth and allow an investment portfolio or a retirement portfolio to grow more quickly, keeping in mind that within the corporation the investment income itself will likely be taxed a higher rate than the active business income.

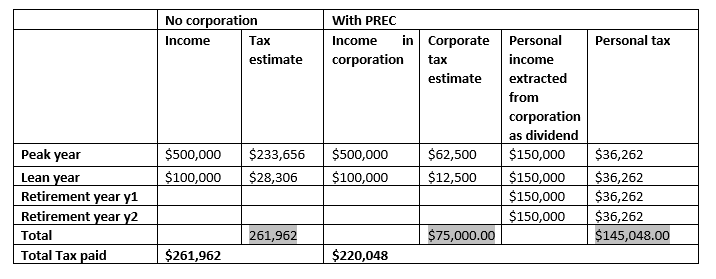

An additional tax advantage is that the real estate professional can distribute their career earnings over their lifetime. Rather than pay the highest personal tax rate in peak earning years, the real estate professional can extract income from the corporation in leaner years, or in retirement, at a lower marginal tax rate. For example:

As the chart indicates, using a PREC allows a real estate professional to distribute income earned over multiple years, in turn allowing the professional to access lower marginal tax rates. This can reduce the total amount of taxes paid over a lifetime.

Life Insurance

A further benefit offered by a PREC is that life insurance for the controlling shareholder can be held within the corporation, reducing the amount of pre-tax earnings required to cover the premiums. In addition, life insurance benefits, less the adjusted cost base of the policy, are credited to a corporation’s capital dividend account (“CDA”) and can be extracted from a corporation free of tax. The reduction of the credit to the CDA by the policy’s adjusted cost base is intended to offset the advantage of paying insurance premiums with corporate income, instead of personal income taxed a personal tax rates. Real estate professionals considering having a PREC purchase life insurance should also note that in most cases the PREC will not be entitled to deduct the expense of the insurance premiums.

Income Splitting

The 2017 amendments to the Income Tax Act introduced the tax on split income rules, know as “TOSI”, which have significantly curtailed the ability of professionals to use professional corporations to split their income with low earning family members. Previously, professionals could pay dividends from their corporations to family members with low income, allowing the family to benefit from the lower tax rate applicable to the professional’s spouse or children. The TOSI rules now require that in order for corporate dividends to be taxed in the hands of a lower earning family member, that family member must be actively engaged in the professional’s business, meaning, for example, that the family member works in the business at least an average of twenty hours per week.

Restrictions

A PREC can limit a controlling shareholder from standard corporate financial liabilities. However, a PREC does not limit professional liability, which is governed by the Real Estate Council of Ontario pursuant to the Real Estate and Business Brokers Act, 2002.

In addition, like other professional corporations, PRECs are subject to restrictions. In particular, all of the equity shares of a PREC must be held directly or indirectly by the controlling shareholder, being an individual salesperson or broker registered with the Real Estate Council of Ontario;[2] the controlling shareholder must be employed by a brokerage; the controlling shareholder, must be the sole director and officer of the corporation;[3] and family members of the registrant can only hold non-voting and non-equity shares of the corporation.

Conclusion

Given the current “heat” of the Toronto real estate market, incorporation may be an attractive option for real estate agents or brokers. However, unless a real estate professional is earning substantially more than their everyday expenses, incorporation may not be beneficial. Additionally, real estate professionals should take the TOSI rules into account when deciding whether or not to incorporate. Anyone considering establishing a PREC should consult with their tax professionals for specific advice.

[1] British Columbia 2008 – Real Estate Services Regulation – Real Estate Services Act

Saskatchewan – see, Section 5 The Professional Corporations Regulations, 2002 under the Professional Corporations Act.

Quebec see section 34.1 of Regulation respecting brokerage requirements, professional conduct of brokers and advertising under the Real Estate Brokerage Act.

[2] Subsection 2(2)

[3] Subsection 2(3) and 2(4)

In order to increase tax transparency across the globe, the Organisation for Economic Co-operation and Development (OECD) adopted the Common Reporting Standard (CRS) on July 15, 2014. The CRS initiative calls on each participating jurisdiction to obtain information from financial institutions within their country and automatically exchange that information with other jurisdictions on an annual basis. The objective is to increase tax compliance by providing key information to the participating jurisdictions allowing them to identify whether their citizens accurately report their foreign assets and income. However, since the CRS is not constraining, 90 jurisdictions have also signed the Multilateral Competent Authority Agreement (MCAA) on automatic exchange of financial account information. The MCAA provides a mechanism to facilitate the exchange of information in accordance with the CRS. Such information to be disclosed includes the following :

Afin d’accroître la transparence fiscale à travers le monde, l’Organisation de coopération et de développement économiques (OCDE) a adopté la norme commune de déclaration (NCD) le 15 juillet 2014. L’initiative de la NCD invite les juridictions participantes à obtenir des renseignements auprès des institutions financières de leur pays et à les échanger automatiquement avec d’autres juridictions sur une base annuelle. L’objectif est d’accroître l’observation des règles fiscales en fournissant des renseignements importants aux juridictions participantes afin de leur permettre de déterminer si leurs citoyens déclarent correctement leurs actifs et leurs revenus étrangers.

Cependant, puisque la NCD n’est pas contraignante, 90 juridictions ont également signé l’Accord Multilatéral entre Autorités Compétentes (AMAC) sur l’échange automatique de renseignements financiers. L’AMAC fournit un mécanisme pour faciliter l’échange de renseignements conformément à la NCD. Les renseignements à divulguer comprennent ce qui suit :